Close Accounting Cycle for the Month(Period)

This is where you will print, verify and save your monthly reports, then close the accounts for the month. After completing this Close, you are ready to begin a new Period accounting cycle.

TUTORIAL SCENARIO

Execute each of the steps below for Company Number 01 and all other values as shown in the respective images EXCEPT FOR DATES. Use dates that will apply to the dates you entered earlier in the tutorial for your transactions. Refer to the respective Notes on Fields if you need more info. When finished with each section Return to the Tutorial.

Follow the steps below to Close the Accounting Cycle for the Period (Month).

1. PRINT, VERIFY AND SAVE THE FOLLOWING REPORTS

AR Inquiry Report, listing invoices with balance of zero. Invoices with a balance of zero, are dropped during the Period Close, and printing this report gives you a last printed record of them. Compare AR Inquiry report to GL Number = 11300 of the Trial Balance.

AP Inquiry Report, listing invoices with balance of zero. Invoices with a balance of zero, are dropped during the Period Close, and printing this report gives you a last printed record of them. Compare A/P Inquiry report to GL Number = 21000 of the Trial Balance.

If you have Suspense balance, print the Non Released Suspense Summary report and compare life to date total to GL number = 21010 of the Trial Balance, which is printed later.

If you have Minimum Withhold amounts, print the Minimum Withhold Summary report and compare the year to date total to GL number = 21011 of the Trial Balance, which is printed later.

If you have Prepay amounts, print the Prepayment report and compare the prepay balance to your GL number for prepayments - usually something like 21050 - in the Trial Balance, which is printed later.

Print a Company Prelimanary Profit and Loss Statement and Balance Sheet. Stressing the Net profit should be the same on the gross side as on the Company side. We get a lot of questions on this. Clients close a period do not print the P&L and any difference keeps accumulating to the year to date. If they don't match, see example of how they are computed in Frequent Questions for Period Close.

2. RUN THE CHECK IN BALANCE ROUTINE

Select Close - Period Close - Check In Balance.

See Notes on Check In Balance Procedure for more info.

This program verifies that the Transaction File totals to zero. This means you have a debit for each credit entry.

Enter the Beginning and Ending Transaction Date and

Click OK.

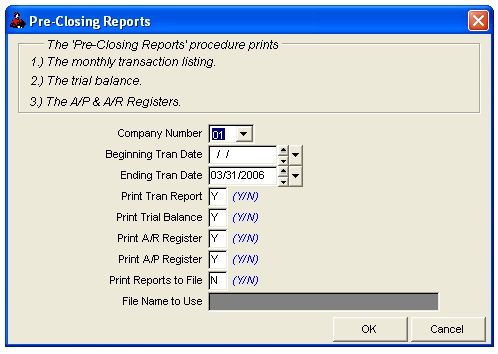

3. PRINT, VERIFY & SAVE THE PRE-CLOSING REPORTS

Select Close - Period Close - PreClosing Reports.

Manually verify all Pre-Closing Reports for following:

Transaction file totals to zero.

Trial Balance totals to zero.

AP Posting Register period Total should equal the AP period Total in the Trial Balance

AR Posting Register period Total should equal the AR period Total in the Trial Balance

Be sure you have manually verified the reports before continuing. Executing the update transactions to general ledger procedure will prevent you from making corrections and reprinting the above reports, UNLESS YOU HAVE A BACKUP, in which case you can always restore the data make corrections and repeat the end of period procedures.

You can print your Pre-Closing reports to a file. This saves your reports on the hard drive so that you can print them later. Roughneck will ask you for a “File Name to Use”, and it will default to your computer’s date. Then it will store the Pre-Closing reports on your hard drive for you to print later (Ex: Trial Balance = TB2006-6-31.rep). After you have printed the reports to a file you can go to Utilities, Data Tools, then Print Report Files. Select the report you want and print.

4. MAKE A BACKUP

It's a good idea to always make a Permanent Backup to a diskette, CD, or some other removable device prior to Updating Transactions to general ledger. Store the diskette or CD in a safe place for permanent storage. Do not rely on the temporary backup to hard disk for permanent storage.

5. UPDATE TRANSACTIONS TO GL

From the Drop Down Menu, select Close - Period - Update Transactions to GL.

Be sure you have verified all reports before updating transactions to the general ledger.

Normally answer ‘Yes’ to clear Accounts Receivable period and Accounts Payable period Posting Registers. Invoices with a balance of zero are dropped. New posting registers are created for the next period. Clearing the Accounts Payable and Accounts Receivable Posting Registers will move current postings to the Year to Date Accounts Payable Posting Register and the Year to Date Accounts Receivable Posting Register only for the beginning and ending dates specified in the close period. Any unpaid Accounts Receivable or Accounts Payable invoices remain in the ARDET.DBF file for Accounts Receivable and APDET.DBF file for Accounts Payable.

Update transactions to the general ledger will post debit or credit total for each general ledger account to the Company Chart of Accounts. Sales, taxes and expenses for a unit will post debit or credit total to each general ledger account in the Unit Chart of Accounts. Oil/gas volumes for sales are posted to the Unit/Well file. All debits and credits for each general ledger account will move from the Transactions file to the Year to Date Transaction file. Only transactions within the specified beginning and ending dates are closed. Once the period is closed, print the required Financial reports. The Financial reports are current as of the last closed period. If you have more than one company you must close the period for each company.

Click OK.

You are finished Closing the Period.

Reltated Topics

Frequently Asked Questions about Closing a Period

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.